kentucky lottery tax calculator

Income tax withheld by the US government including income from lottery prize money. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding.

Lottery Tax Calculator Updated 2022 Lottery N Go

The taxes you will have to pay in order to receive.

. This is actually a favorable change toward the previous policy. When it comes to paying taxes your. Kentuckys individual income tax law is based on the Internal Revenue Code in effect as of December 31 2018.

The statistics indicate that India has one of the harshest taxes in the world. In addition some locations such as New York City levy a local tax on lottery winnings. The latest changes to the lottery law imply that you will have to pay 28 on all winnings.

Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the state you live in the state you bought the ticket in and a few other factors. By law Kentucky lottery will withhold 24 of winnings for federal taxes and 50 for state income taxes. Capital gains are taxed as regular income in Kentucky.

5 Louisiana state tax on lottery winnings in USA. Please note the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Lottery tax rate is 65. 51 rows The State Tax Calculator. Heres a breakdown of how the money is distributed for each and every dollar we receive.

Lottery tax calculator takes 0 percent since there is no lottery in the state. Overview of Kentucky Taxes. And you must report the entire amount you receive each year on your tax return.

That means your winnings are taxed the same as your wages or salary. The lottery automatically withholds 24 of the jackpot payment for federal taxes. India used to tax 309 plus additional income tax.

25 State Tax. Lottery tax calculator takes 6. The tax rate is the same no matter what filing status you use.

Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and. This varies across states and can range from 0 to more than 8. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Kentucky state tax on lottery winnings in USA. Where the Money Goes KY Lottery. Weve created this calculator to help you out with lottery taxes.

This is still below the national average. Other United States Lotteries. Kentucky imposes a flat income tax of 5.

In some states the lottery also withholds a percentage of the payment for state taxes. The money you spend on each and every Kentucky Lottery game you play goes many different places including to the funding of Kentucky college scholarships. The Pulaski County man made the drive to lottery headquarters later that day walking away with a check for 1236820 after taxes.

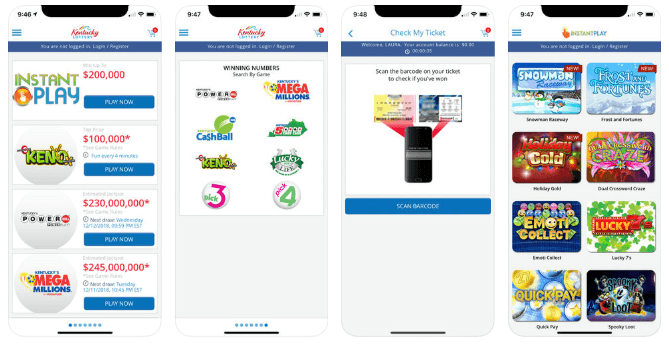

This can range from 24 to 37 of your winnings. Kentucky KY lottery results winning numbers and prize payouts for Pick 3 Pick 4 Lucky for Life Powerball Mega Millions Cash Ball 225 5 Card Cash. Kentucky Capital Gains Tax.

The Kentucky State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Kentucky State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Our tax calculator can be accessed and used free in any state and is great to use in the more popular gambling states like NJ NV MI PA IN and CO. The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019.

He chose to take the lump sum cash payment of 1742000. The Kentucky Department of Revenue is responsible for publishing the. Lottery tax calculator takes 699.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. Instead Stumbo said lawmakers will unveil legislation on Tuesday that will call for the lottery to create new games including Keno that could generate about 25 million for the pension system. Kentucky Cigarette Tax.

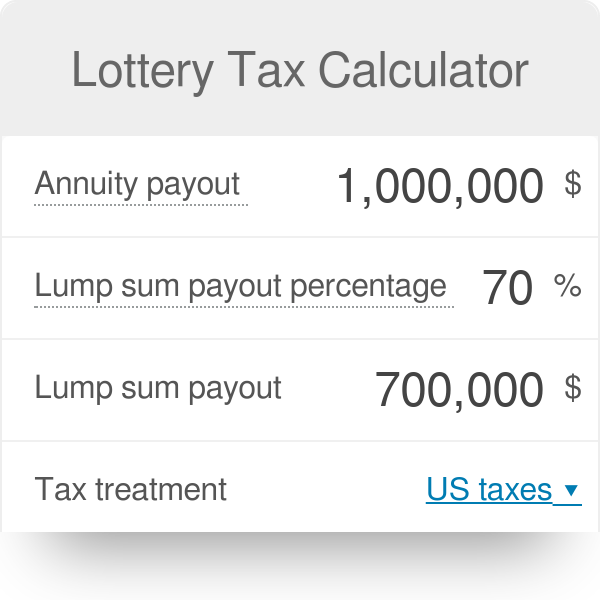

Lottery tax calculator takes 765 on 2000 or more. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Additional tax withheld dependent on the state.

Recently the Mega Millions hit a whopping 1 billion If you held the winning ticket for that drawing you would have paid 60 million right off the top to the state of Kentucky alone. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Im a single dad so I can really use the money Turner said.

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the. For example lets say you elected to receive your lottery winnings in the form of annuity. After a few seconds you will be provided with a full breakdown of the tax you are paying.

You can find out how much tax you might have to pay below. That means they are subject to the full income tax at a rate of 5. For several people gambling can mean regularly betting on sports to buying the occasional lottery ticket.

Kentucky imposes a 6 percent tax rate on all lottery winningsThat may not sound like a lot but it adds up very quickly. The table below shows the payout schedule for a jackpot of 133000000 for a ticket purchased in Kentucky including taxes withheld. Use our Powerball payout and tax calculator to find out how much taxes you need to pay if you win the Powerball jackpot for both cash and annuity options.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. A federal tax is levied on all winners of prizes greater than 5000 while many of the participating states apply their own tax on top of this. Lottery Winning Taxes for India.

The taxes that are taken into account in the calculation consist of your Federal Tax Kentucky State Tax Social Security and Medicare costs that you will be paying when earning 4000000. When you file your next return after winning you will be responsible for the difference between the 24 tax and the total amount you owe to the IRS. Taxes on a 250000 lottery would be 17500 based on their states guidelines of 7.

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes.

How Long After Winning The Lottery Do You Get The Money

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Powerball Tax Calculator Payout Calculator

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Lottery Tax Calculator Updated 2022 Lottery N Go

Taxes On Lottery Winnings In Kentucky Sapling

Lottery Taxes The Triple Tax Effect Ellsworth Associates Cpas Accountants In Cincinnati

Lottery Tax Rates Vary Greatly By State

![]()

South Africa Kwazulu Natal To Raise Gaming Taxes

How Long After Winning The Lottery Do You Get The Money In All Lotteries

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Comparethelotto Usa Lottery Odds Calculators Results And More